100 Bonus Depreciation On Cars 2022

100 Bonus Depreciation On Cars 2022

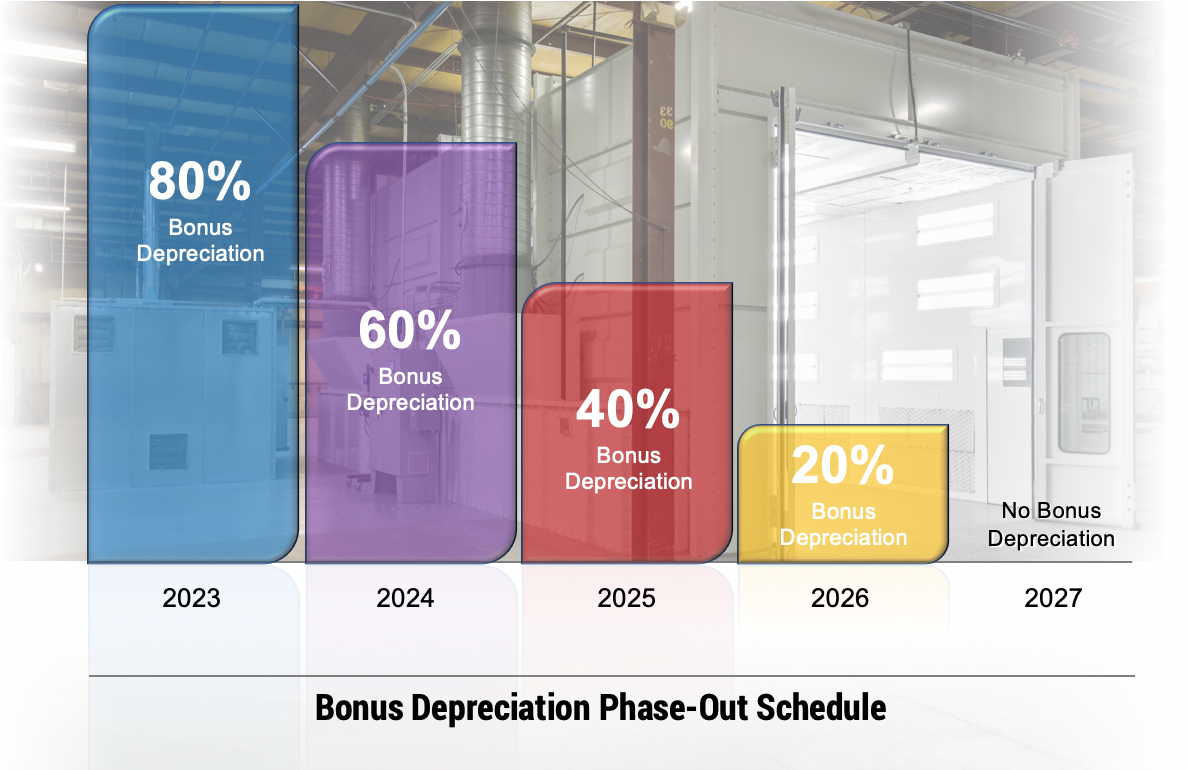

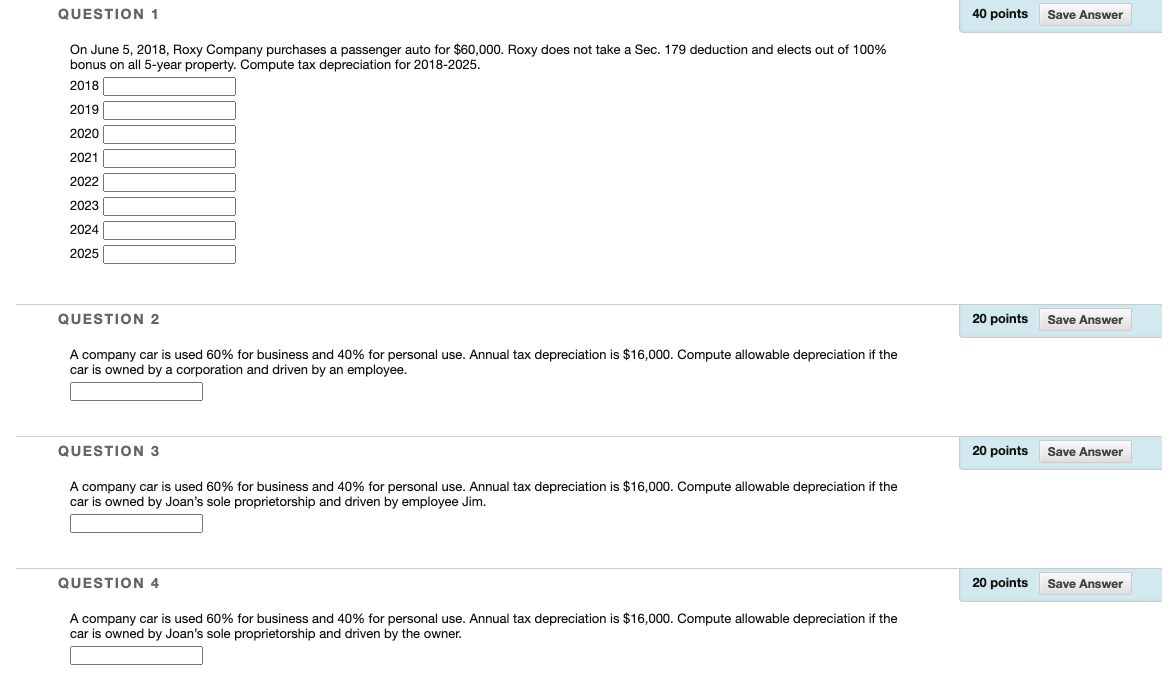

The TCJA also permitted certain used items to qualify for 100 bonus depreciation. You might get a state tax income deduction too. The Tax Cuts and Jobs Act substantially increased the maximum depreciation deductions for passenger automobiles and extended the additional first-year depreciation limit. After that first-year bonus depreciation goes down as follows.

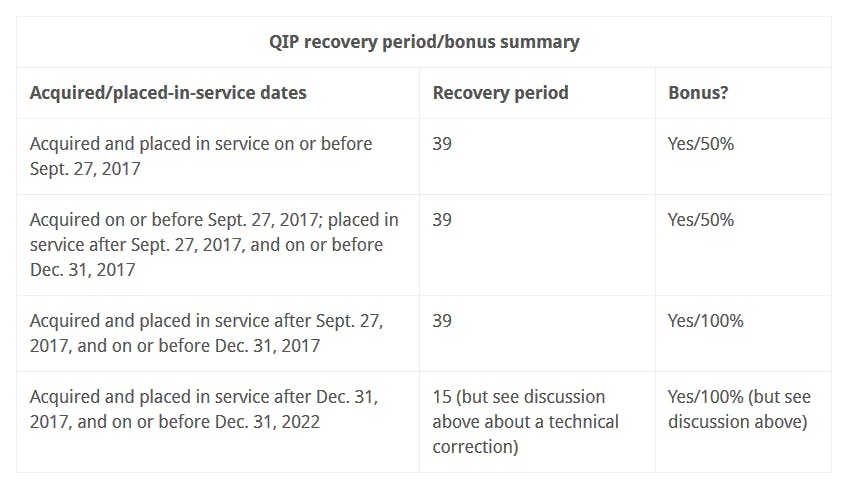

Bonus Depreciation Rules Recovery Periods For Real Property And Expanded Section 179 Expensing Baker Tilly

Thats the plan unless Congress extends the bonus depreciation rate.

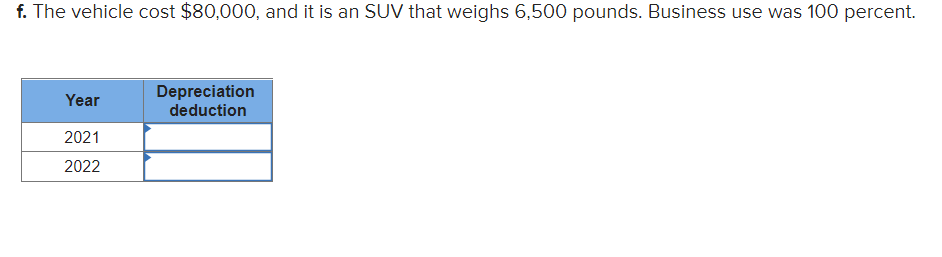

100 Bonus Depreciation On Cars 2022. However bonus depreciation for passenger vehicles is limited to 8000. 28 2017 and placed in service before Jan. Fuel repairs maintenance etc.

27 2017 and before Jan. For qualified property placed in service between September 28 2017 and December 31 2022 or by December 31 2023 for certain property with longer production periods the first-year bonus depreciation percentage increases to 100. It allows a business to write off more of the cost of an asset in the year the company starts using it.

The bonus depreciation percentage for qualified property that a taxpayer acquired before Sept. Bonus depreciation. Bonus depreciation is a way to accelerate depreciation.

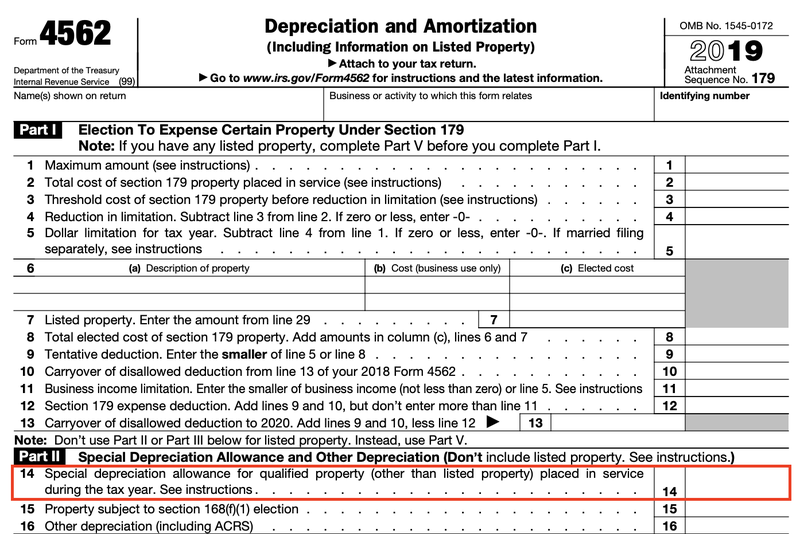

The Ultimate Fleet Tax Guide Section 179 Gps Trackit

Bonus Depreciation Rules Recovery Periods For Real Property And Expanded Section 179 Expensing Baker Tilly

What Is Bonus Depreciation A Small Business Guide The Blueprint

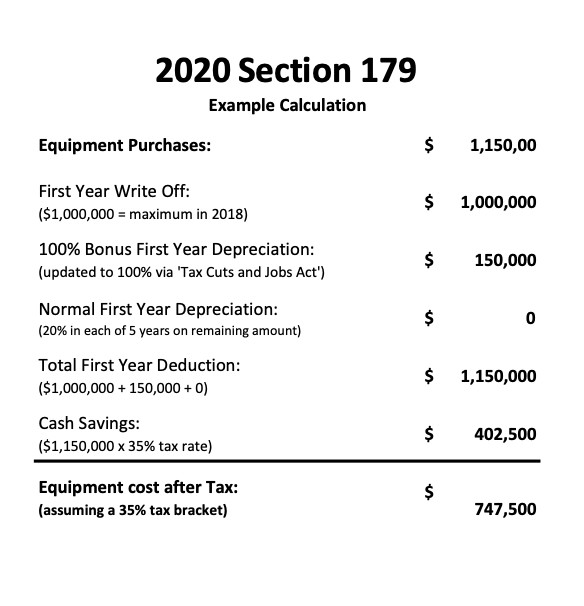

2020 Section 179 Commercial Vehicle Tax Deduction

Section 179 Tax Deduction At Bill Utter Ford

Need A New Business Vehicle Consider A Heavy Suv Fmd

6 000 Pound Vehicle List Special Irs Depreciation Tax Benefit Diminished Value Of Georgia

Solved Lina Purchased A New Car For Use In Her Business Chegg Com

Question 1 40 Points Save Answer On June 5 2018 Chegg Com

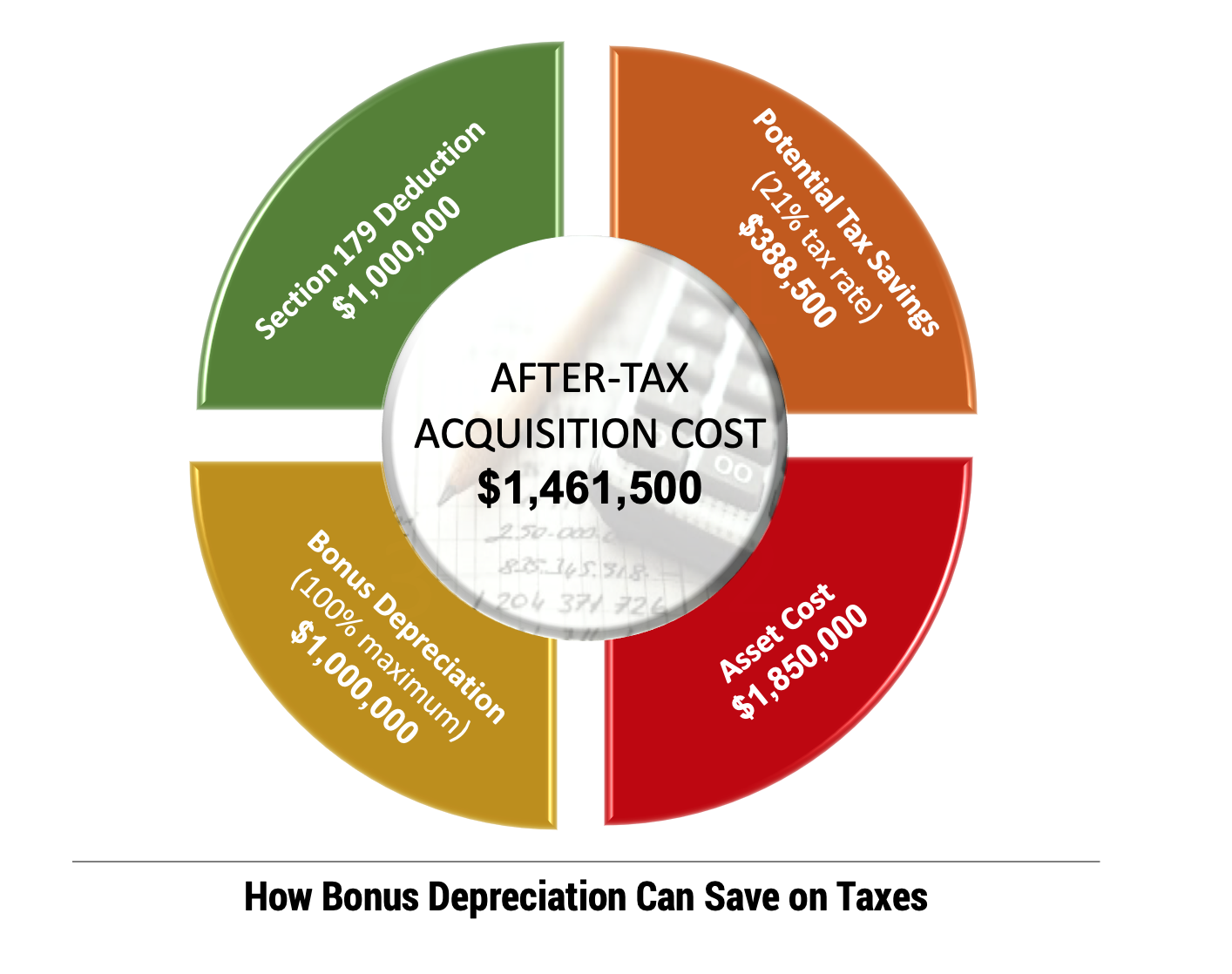

Valuable Tax Savings On Capital Equipment Through Bonus Depreciation

Bonus Depreciation Safe Harbor Rules Issued For Vehicles And 4 Other Tax Provisions Business Owners Need To Know About Using Their Cars For Work

Where The Past And The Future Collide Internal Versus Tax Depreciation Mckonly Asbury

Valuable Tax Savings On Capital Equipment Through Bonus Depreciation

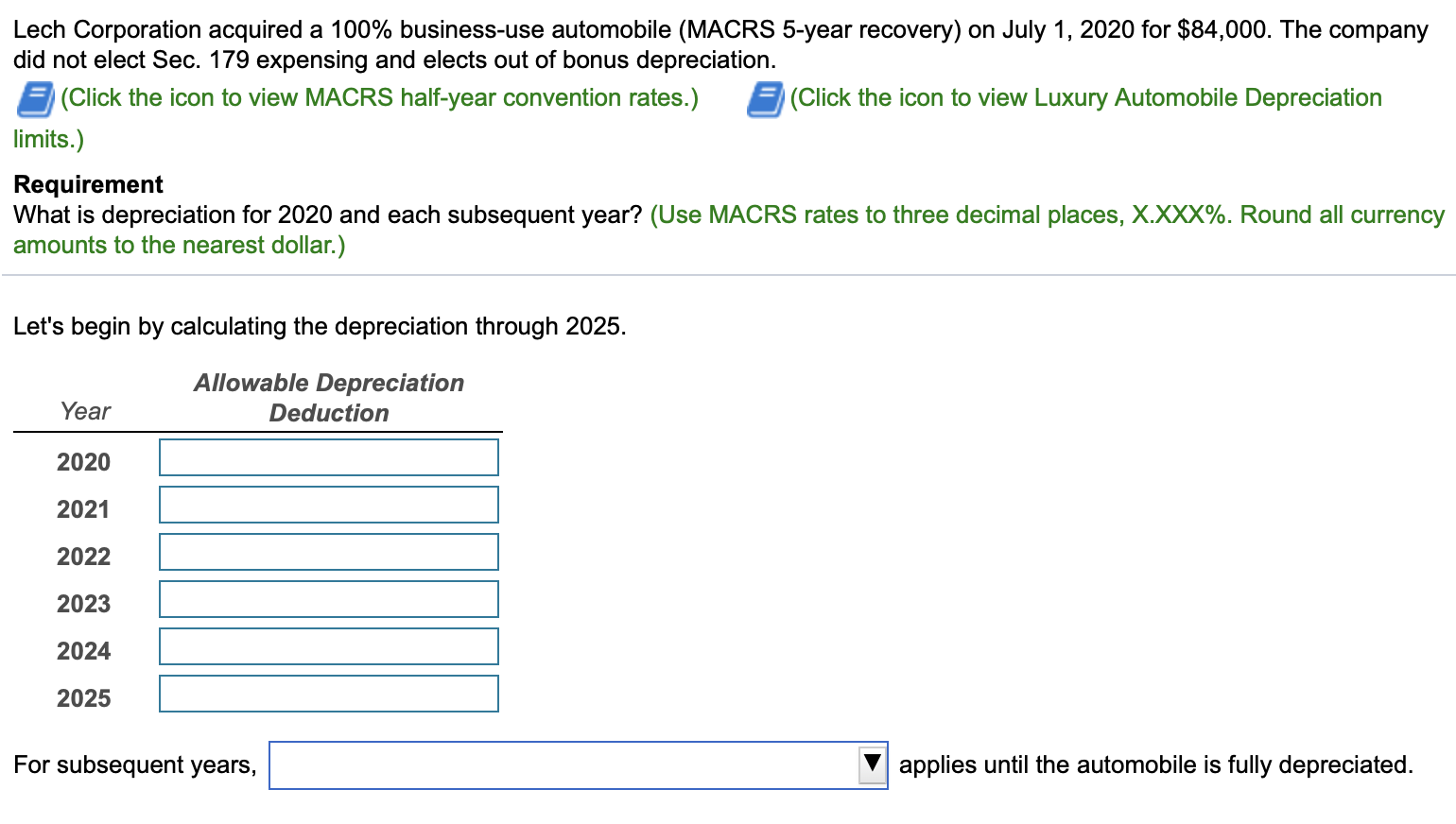

Solved Lech Corporation Acquired A 100 Business Use Chegg Com

Need A New Business Vehicle Heavy Suvs Have Tax Benefits Landmark

![]()

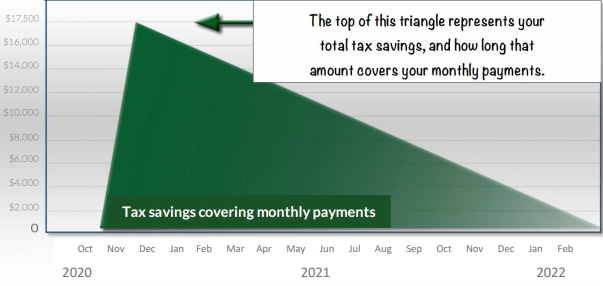

Business Depreciation What Is It And How Can It Improve Cash Flow Beacon Funding Corporation

Limitation On Luxury Automobile Depreciation Depreciation Guru

Vehicle Deduction 2019 First Year Depreciation Breaks West La Cpa

Maserati Section 179 Deduction For Vehicles Joe Rizza Maserati

Post a Comment for "100 Bonus Depreciation On Cars 2022"