Bonus Depreciation On Cars 2022

Bonus Depreciation On Cars 2022

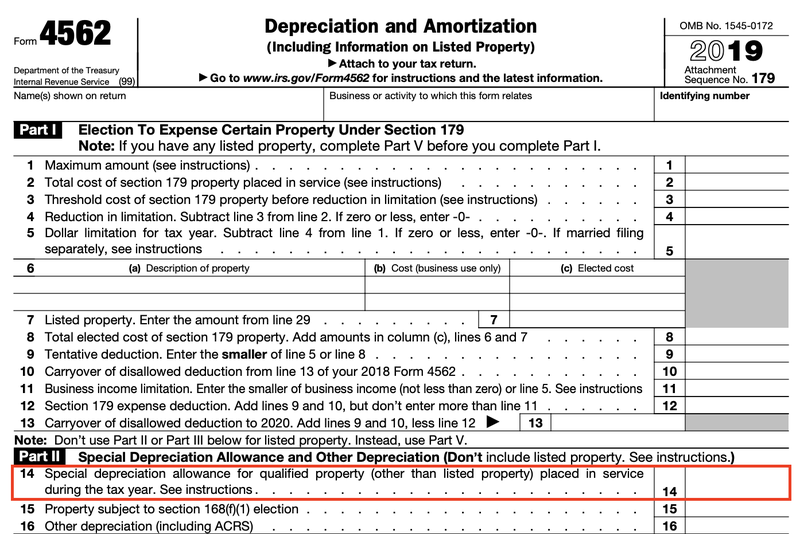

Year 1 deduction 2021 using 100 bonus depreciation 18200 Remaining basis of the car 41800 MACRS depreciation 2022 Table 5 year 2 five-year assets 32 13376. 18200 for the first year with bonus depreciation. WASHINGTON The Treasury Department and the Internal Revenue Service today released the last set of final regulations implementing the 100 additional first year depreciation deduction that allows businesses to write off the cost of most. During 2018 through 2022 you may deduct in a single year up to 100 of the cost of most types of personal property you use for business with bonus depreciation.

The Ultimate Fleet Tax Guide Section 179 Gps Trackit

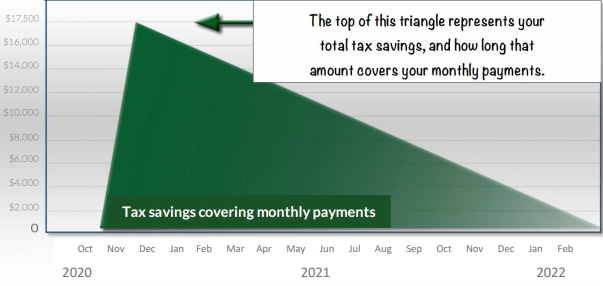

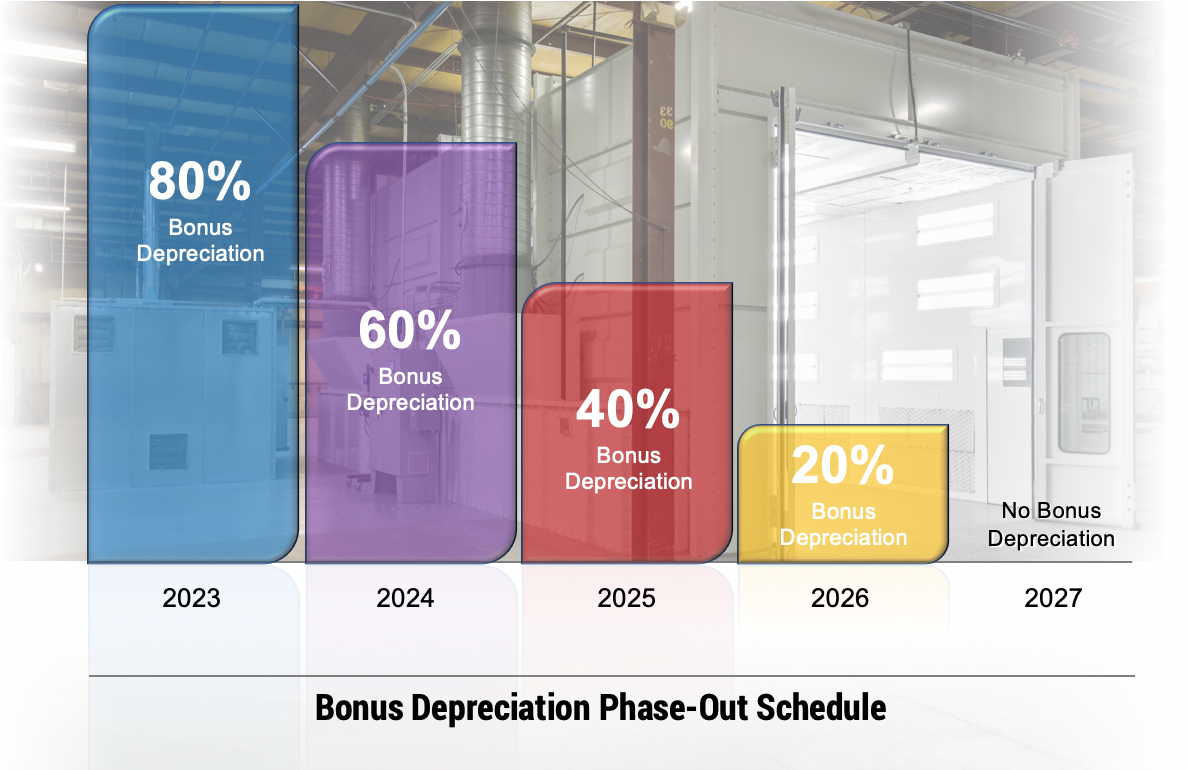

Bonus depreciation is a way to accelerate depreciation.

Bonus Depreciation On Cars 2022. You might get a state tax income deduction too. The Bonus Depreciation provision allows the taxpayer to write off up to 100 of the purchase price on Form 4562 ONLY in the first year of the vehicle. Year 4 and each subsequent year 5760.

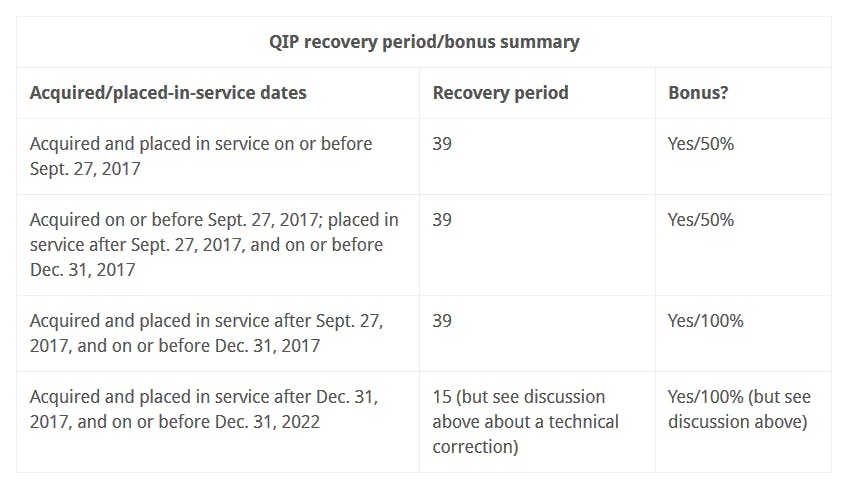

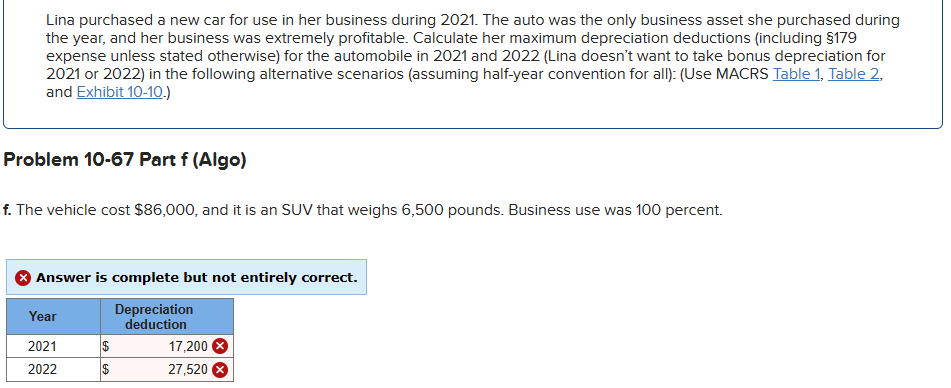

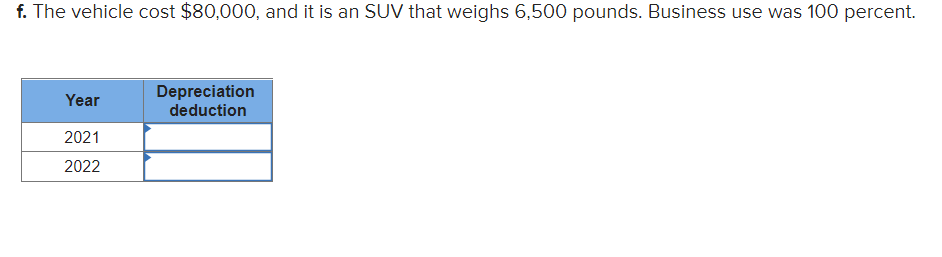

The new law increases the bonus depreciation percentage from 50 percent to 100 percent for qualified property acquired and placed in service after Sept. Depreciation Caps for SUVs Trucks and Vans. Description 2021 2022 Explanation 1 Original Basis of Auto 80000 80000 As Assumed in the problem above 2MACRS Depreciation Rate 20 32 5 year prop 15 year Convention 3 Full MACRS Depreciation expense 16000 25600 1X2 4.

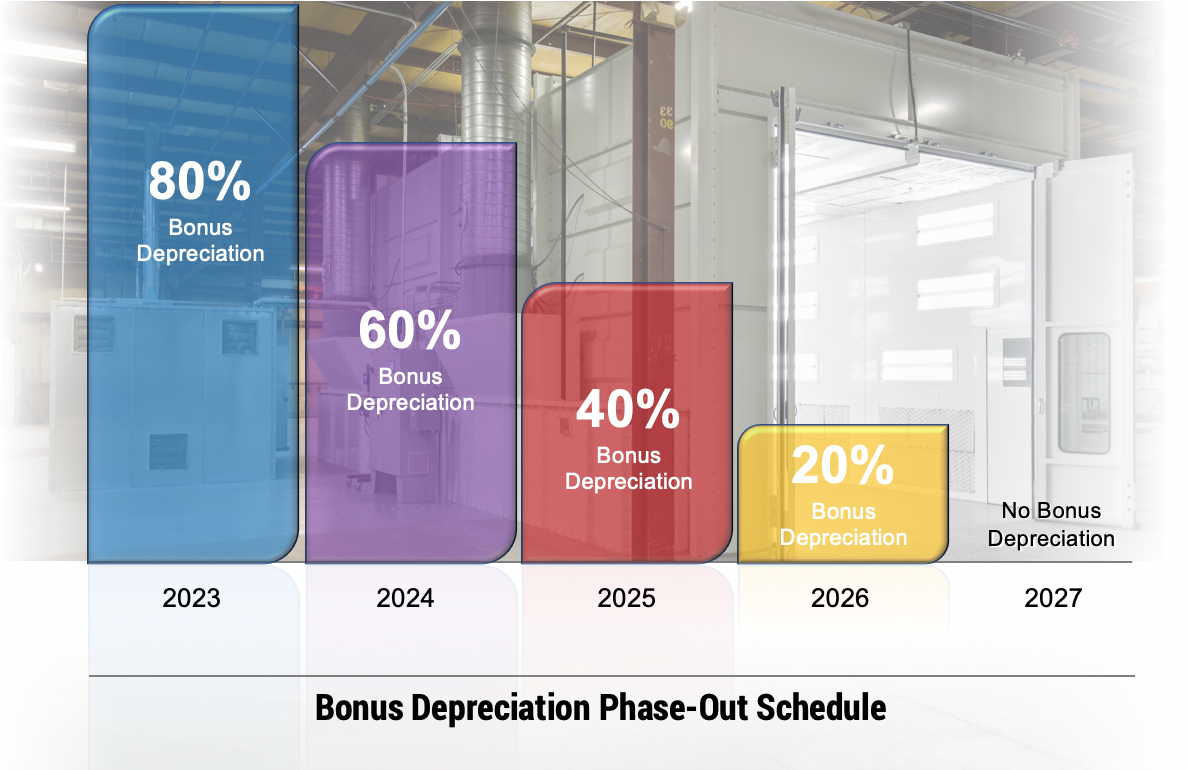

The take-away is that bonus depreciation is essentially a gift of lower income taxes for owners of assets that qualify while it is available. Among other things it greatly expanded bonus depreciation. Bonus Depreciation is a tax provision that currently can only be applied to vehicles placed in service between September 28 2017 and December 31 2022.

Bonus Depreciation Rules Recovery Periods For Real Property And Expanded Section 179 Expensing Baker Tilly

Bonus Depreciation Rules Recovery Periods For Real Property And Expanded Section 179 Expensing Baker Tilly

6 000 Pound Vehicle List Special Irs Depreciation Tax Benefit Diminished Value Of Georgia

What Is Bonus Depreciation A Small Business Guide The Blueprint

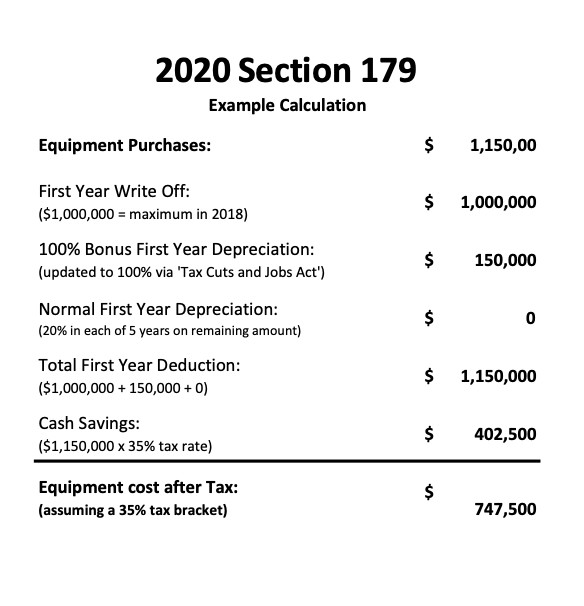

2020 Section 179 Commercial Vehicle Tax Deduction

Irs Announces Luxury Auto Depreciation Caps And Lease Inclusion Amounts Doeren Mayhew Cpas

Handling Us Tax Depreciation In Sap Part 6 Irs Passenger Vehicles Serio Consulting

Depreciation Rate As Per Income Tax Act For Ay 2022 23 New Tax Route

Need A New Business Vehicle Consider A Heavy Suv Fmd

Lina Purchased A New Car For Use In Her Business Chegg Com

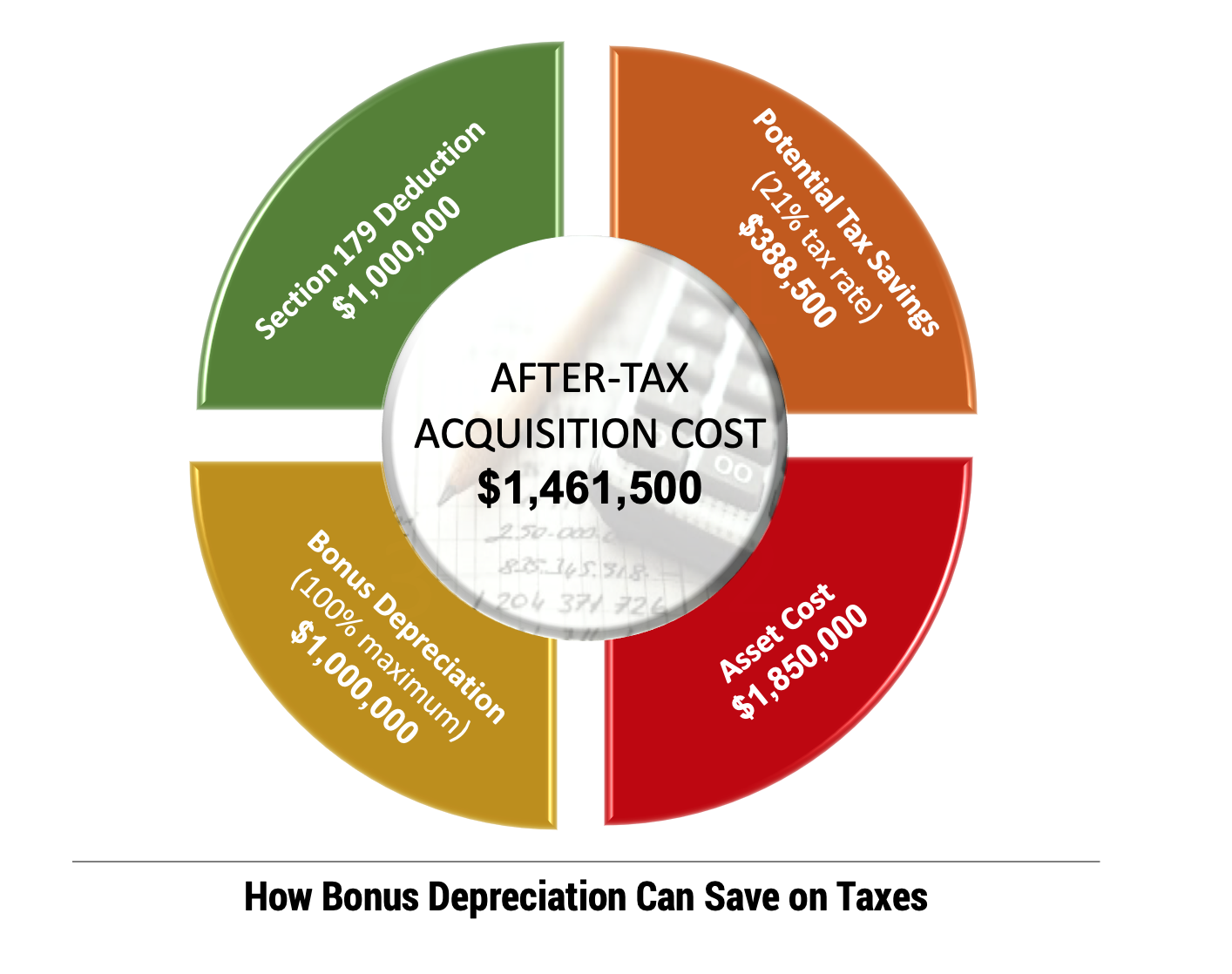

Valuable Tax Savings On Capital Equipment Through Bonus Depreciation

Maserati Section 179 Deduction For Vehicles Joe Rizza Maserati

Valuable Tax Savings On Capital Equipment Through Bonus Depreciation

Irs Issues 2017 Car And Truck Depreciation Limits Journal Of Accountancy

Solved Lina Purchased A New Car For Use In Her Business Chegg Com

Section 179 Tax Deduction At Bill Utter Ford

Vehicle Deduction 2019 First Year Depreciation Breaks West La Cpa

Tcja Changes Deductions For Vehicle Expenses Depreciation

Bonus Depreciation Safe Harbor Rules Issued For Vehicles And 4 Other Tax Provisions Business Owners Need To Know About Using Their Cars For Work

Post a Comment for "Bonus Depreciation On Cars 2022"